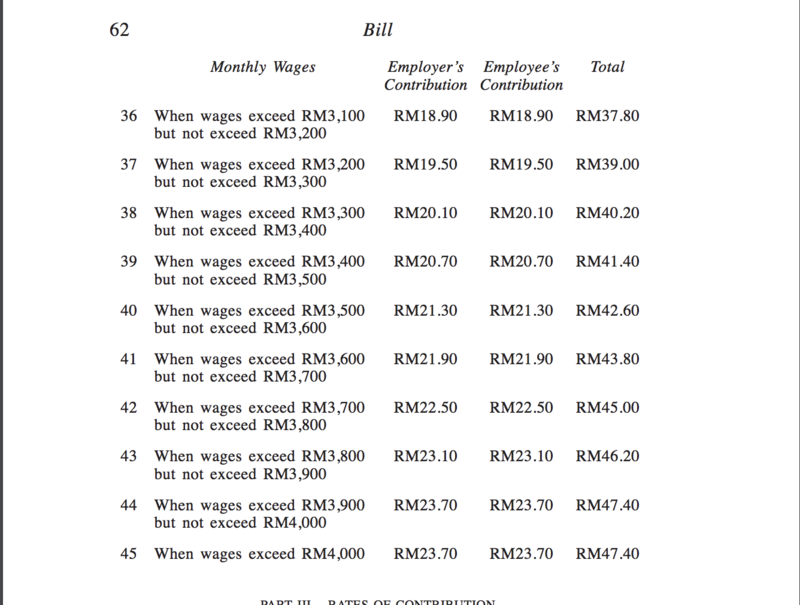

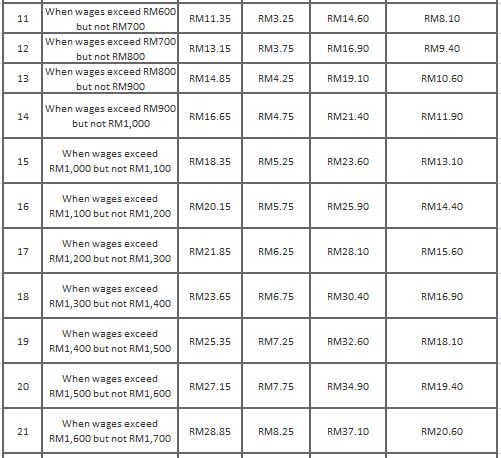

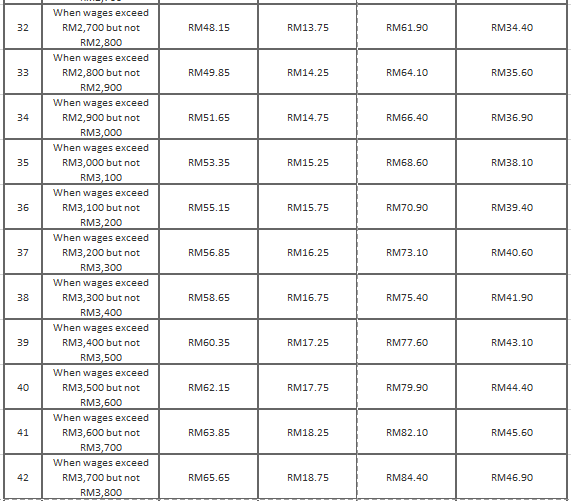

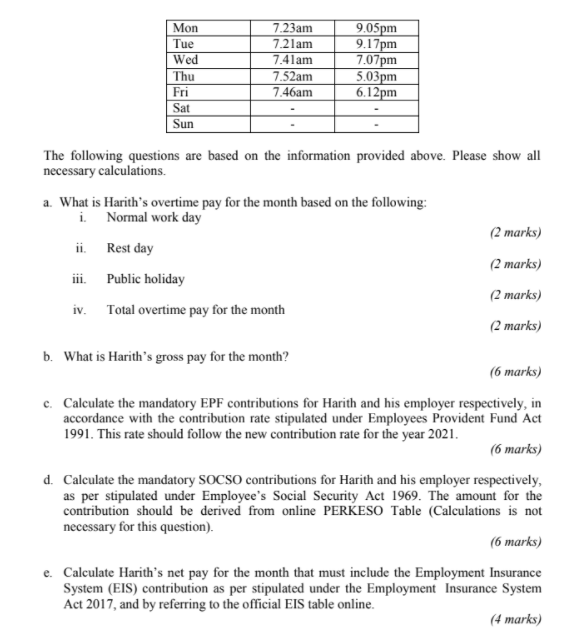

When wages exceed RM30 but not RM50. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age.

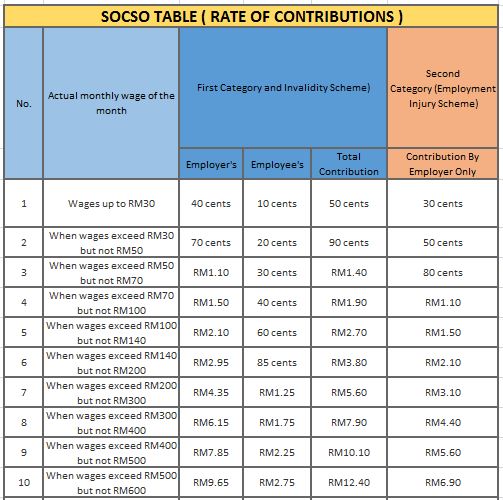

Social Security Protection Scheme

A contribution rate of 0 is set for the Employment Insurance System EIS.

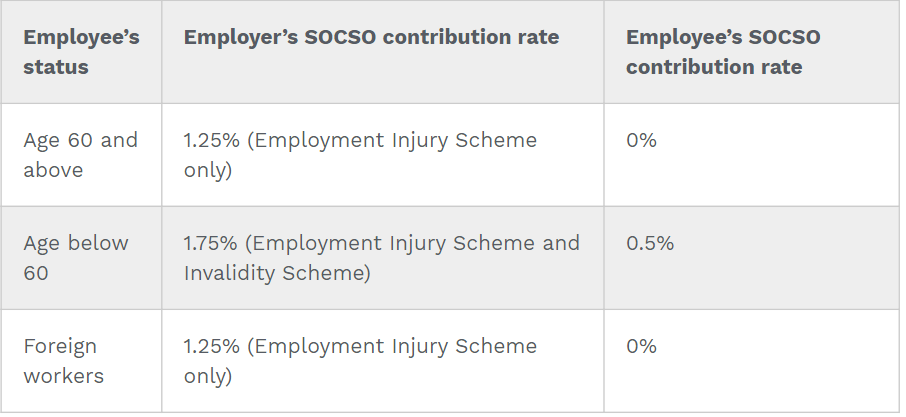

. EIS will start to implement from 1st January 2018. The monthly payment of SOCSO contribution comprising of both employees and employers share should be paid by the 15th of the month for the salary issued for the previous month. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11.

If an employee wishes to continue contributing at the 11 rate they must complete The Borang. Both employers and employees must make monthly EIS contribution. EPF contribution rates for employers and employees as of the year 2021 Following the introduction of budget 2021 the EPF contribution rate for all employed under 60 years old is cut by default from 11 to 9 from February 2021 to January 2022.

For more other information related to latest EIS information can be found at https. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021. Any employers that do not comply with the scheme or make false claims could lead to a maximum RM10000 fine or a jail term of up to two years or both upon conviction.

SOCSO for Businesses in. For LOE starting from 1st January 2021 until 30th June 2022 click HERE to calculate your benefit. The EIS contribution for employees and employers share is.

KWSP - EPF contribution rates. Rates and figures mentioned below are applicable for 2021 and beyond until there is further revision. Both employers and employees are required to contribution 02 of their monthly wages.

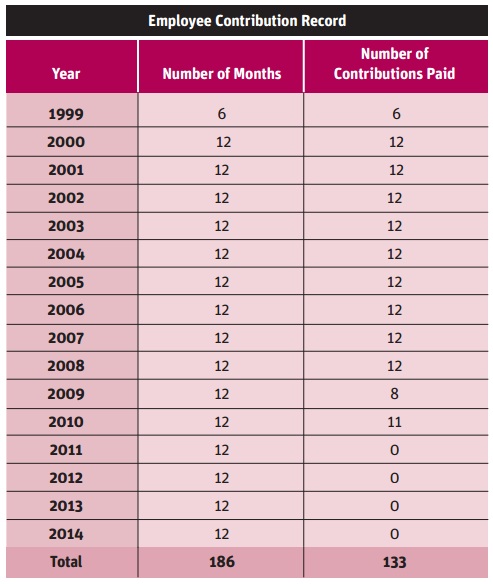

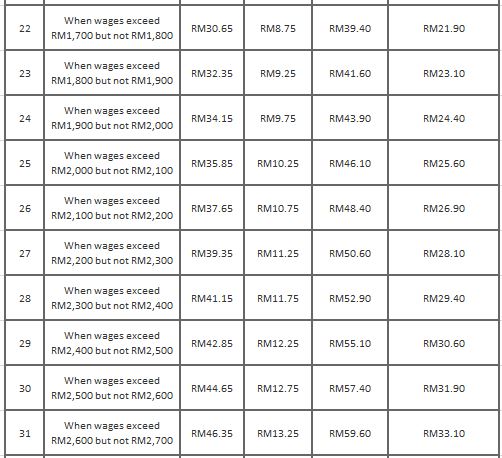

The table of contribution rate can be refer here. Wages up to RM30. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC ie.

EPF Contribution Rates for Employees and Employers. Employer are required to manage and submit EIS contributions to SOCSO. 02 will be paid by the employer while 02 will be deducted from the employees monthly salary.

The number of monthly contributions you have paid before. Contribution rates are set out in the Second Schedule and subject to the rules in Section 18 of the Employment Insurance System Act. Employers must pay 2 of salaries while employees must pay 0.

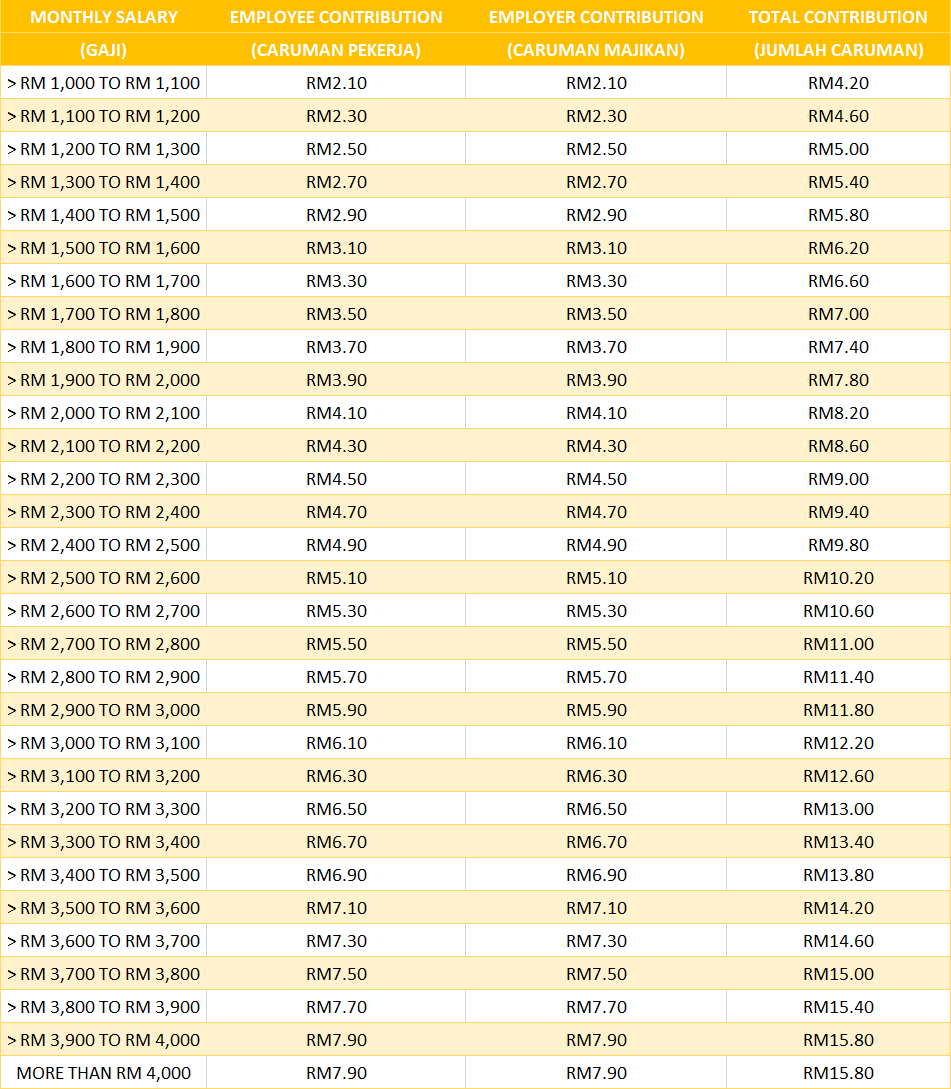

This means that if your employee is earning more than RM4000 a month the contribution from you and your employee is fixed at 04 of RM4000 leading to the maximum amount of contribution capped at RM16 per month. The Employment Insurance System EIS was first implemented in January 2018 by PERKESO. Contributions to the Employment Insurance System EIS are set at 04 of the employees assumed monthly salary.

Based on an employees assumed monthly salary 4. According to the EIS contribution table 02 will be paid by the employer and 02 will be cut from the employees monthly wages. It is a financial scheme aimed at helping employees who lost their jobs until they find new employment.

Each of the columns should show a total amount at the bottom this shows the combined rates for every employee. It does this by offering tax reliefs to individual investors who buy new shares in your. This amount should be equal to the difference between the Total Rate and the EE Contribution.

This calculation only applicable to Loss of Employment LOE starting from 1st January 2021 until 30th June 2022. 46 rows The contribution rate for the Employment Insurance System EIS is from 02 of. EIS is designed so that your company can raise money to help grow your business.

Employment Insurance EIS contributions are set at 04 of an employees estimated monthly wage. BENEFIT CALCULATOR SIP PRIHATIN Note. Lets take a look at how much both parties need to Read more.

Contribution By Employer Only. For better clarity do. Please refer to the following table for more information.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. With the EIS enforced starting from January 1 2018 employers are not allowed to reduce an employees salary indirectly or directly owing to contributions made to the scheme. In addition the column labeled ER contribution shows the percentage of the Total Rate which the employer will shoulder.

Wages up to RM30. A late payment interest rate of 6 per year will be charged for each day of contribution not paid. Benefits are calculated based on your previous assumed salary and your Contributions Qualifying Conditions CQC.

How the scheme works. For LOE happened before 1st January 2021 click HERE to calculate the benefit. According to EIS contribution table contribution rates are specified in the second annex and are governed by the.

Social Security Protection Scheme

Pdf The 5 Pillars Of The Social Security System For The Aged Malaysian

Malaysia S New Insurance System Automatically Asklegal My

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Everything You Need To Know About Running Payroll In Malaysia

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Rate Of Contributions Pdf 5 2 2019 Rate Of Contributions 5 2 2019 Rate Of Contribution Rate Of Contributions No Actual Monthly Wage Of The Course Hero

New Minimum Wage And Socso Requirements Donovan Ho

Socso New Avanzo Management Consulting Services 優卓會計 Facebook

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Socso Contribution Chart Table Rates Chart Contribution Employment

Solved While Waiting For His Sijil Pelajaran Malaysia Spm Chegg Com

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Eis Perkeso Eis Contribution Table Eis Table 2021

Eis Contribution Rate Pdf Eis Contribution Rate The Contribution Rate For Employment Insurance System Eis Is 0 2 For The Employer And 0 2 For Course Hero

Socso Rate Of Contributions Pdf 9 25 2018 Rate Of Contributions Rate Of Contribution Rate Of Contributions No 1 Actual Monthly Wage Of The Course Hero

Socso New Avanzo Management Consulting Services 優卓會計 Facebook